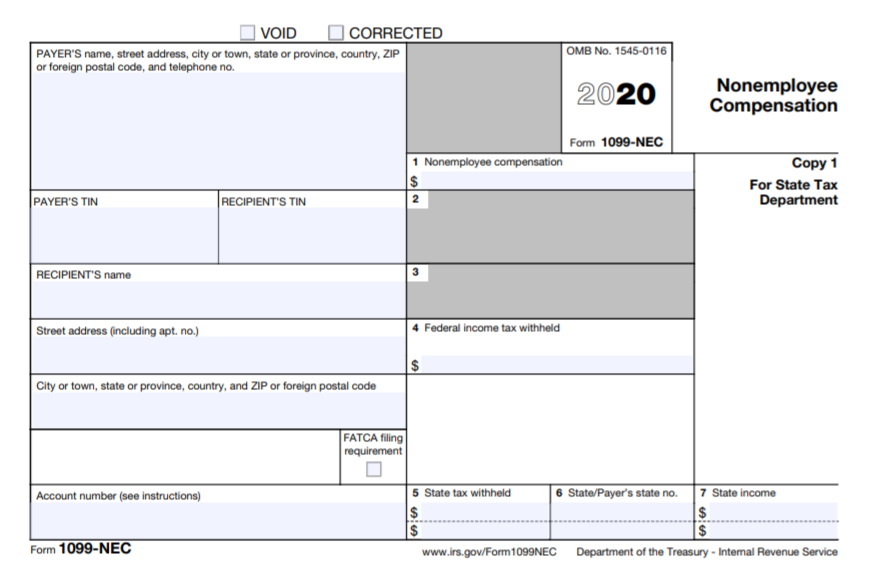

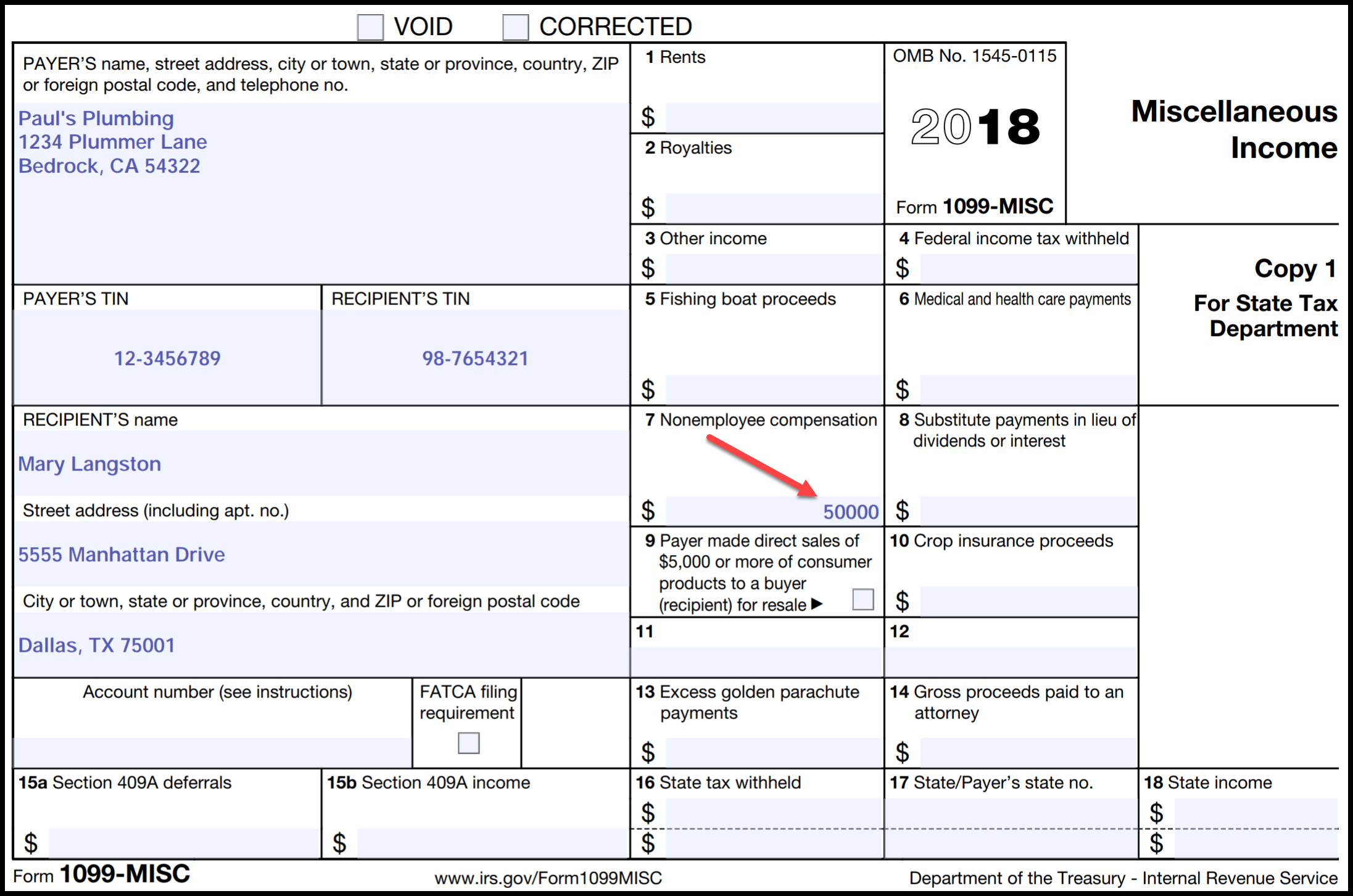

You must provide Form 1099NEC to your contractors each year Understanding Form 1099NEC A company must provide a 1099NEC to each contractor who is paid $600 or more in a calendar year Independent contractors must include all payments on a tax return, including payments that total less than $600 The deadline for filing your 1099MISC form is January 31st Make sure to send both a copy to the contractor and the IRS before this date Lastly, as a business you will also need to submit 1096 form to the IRS This form is a summary of all the 1099 forms you have submitted for each independent contractorClient will not require Contractor to rent or purchase any equipment, product, or service as a condition of entering into this Agreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employees

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

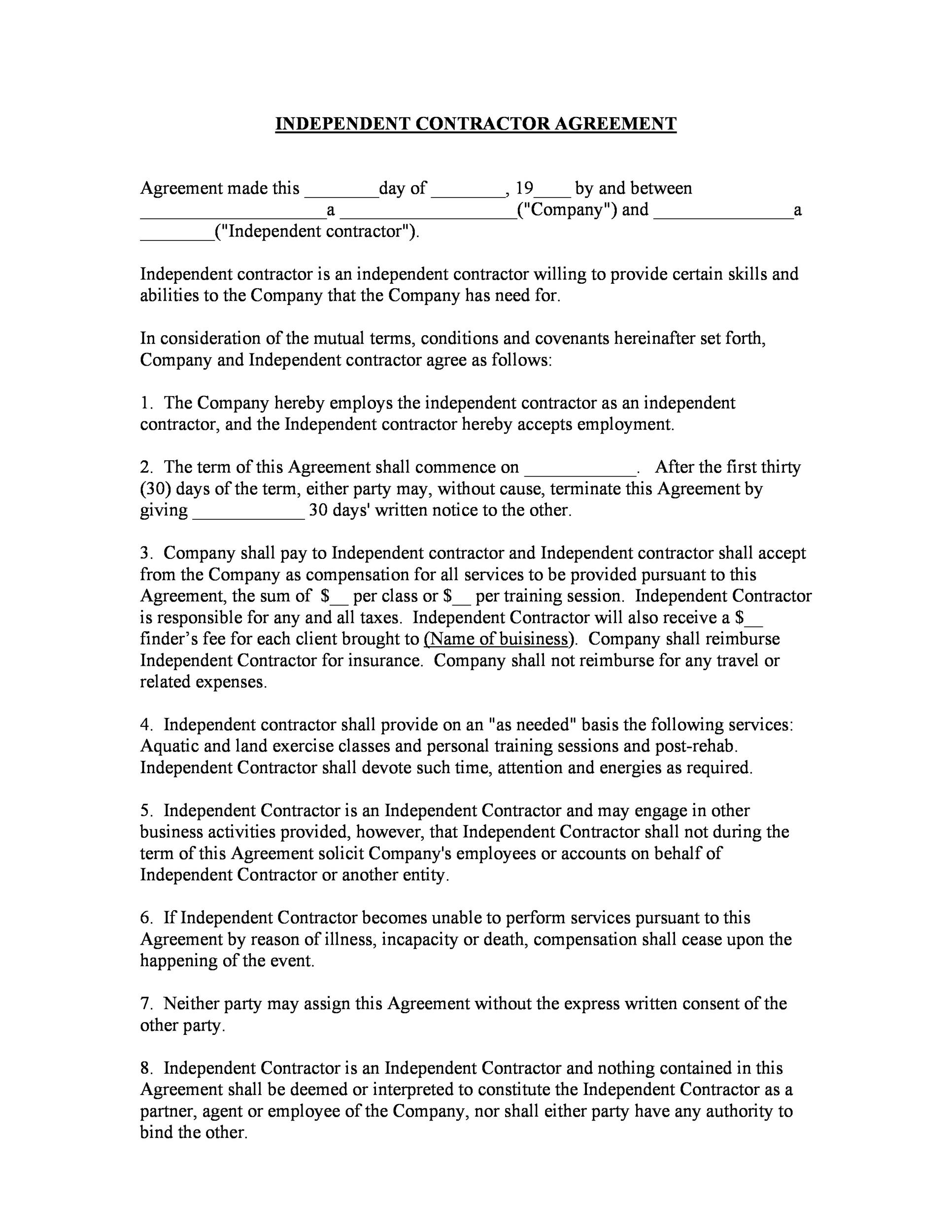

Sample independent contractor 1099 form

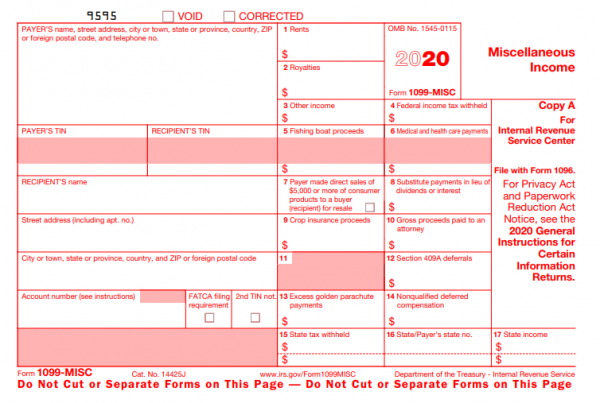

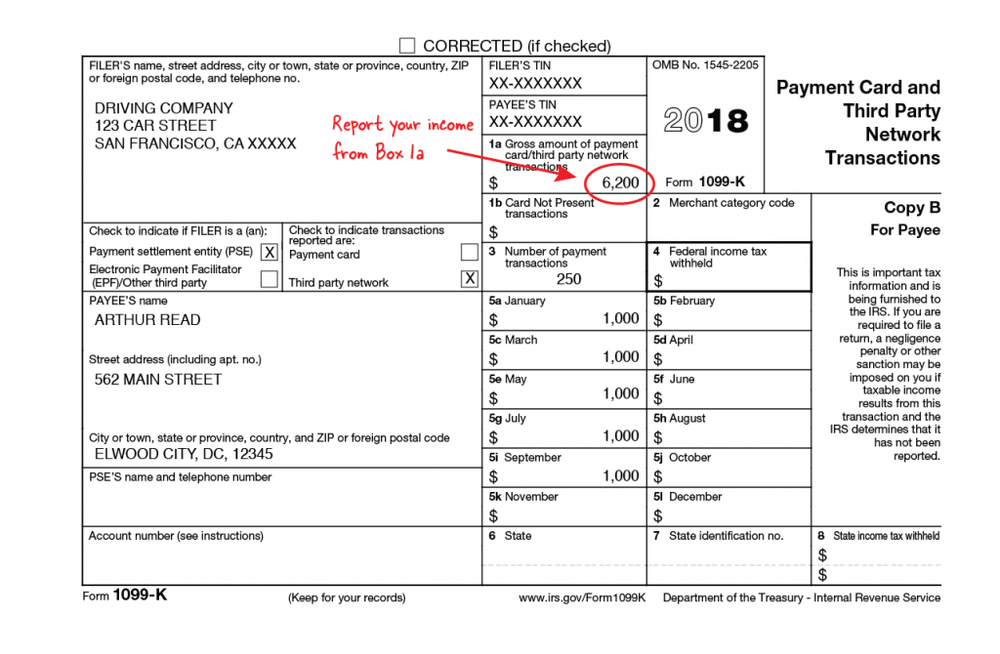

Sample independent contractor 1099 form-Independent Contractor with a tax Form 1099 at the end of each year documenting the amount paid to Independent Contractor The Company will not withhold any taxes, FICA, or other amounts from its payments to Independent Contractor 9 Obligations of Independent Contractor – Independent Contractor acknowledges and agrees For each independent contractor you paid $600 or more during the year, you must report the total amount paid on Form 1099NEC This form includes information about your payments to the independent contractor, but it doesn't usually include tax withholding unless the person is subject to backup withholding (explained below)

Free Florida Independent Contractor Agreement Pdf Word

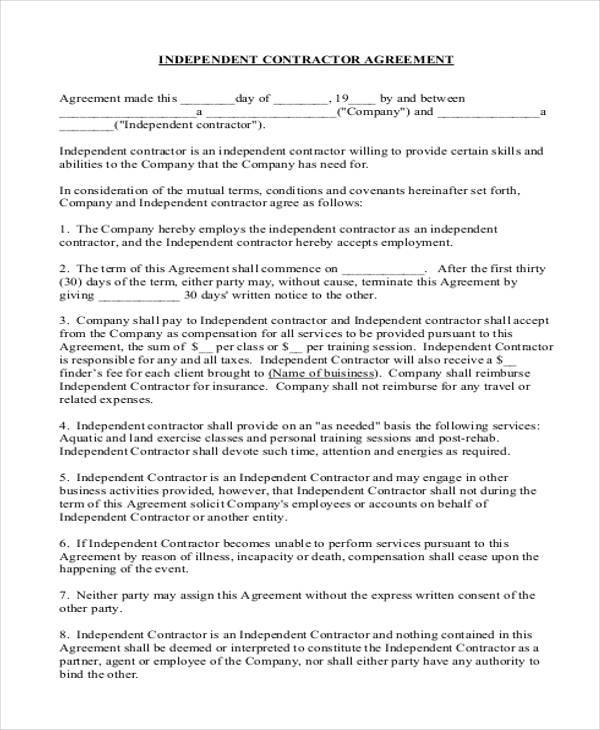

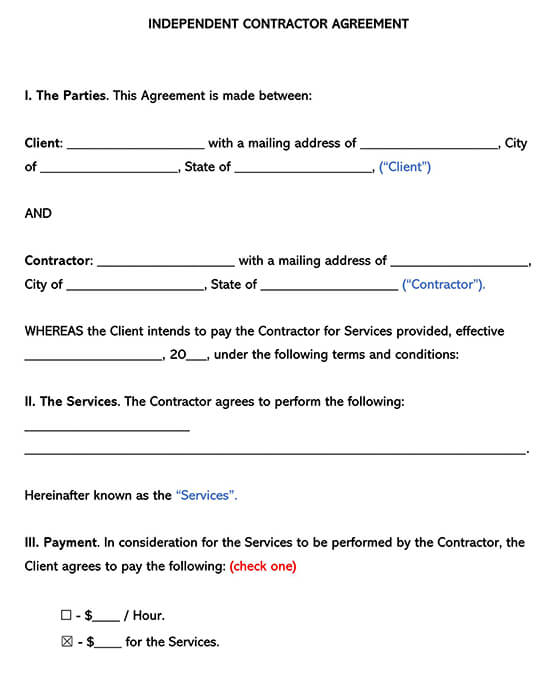

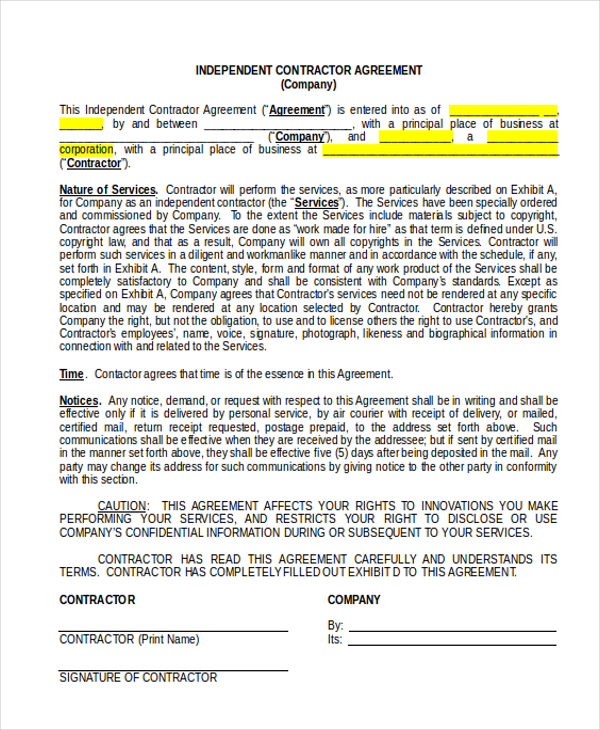

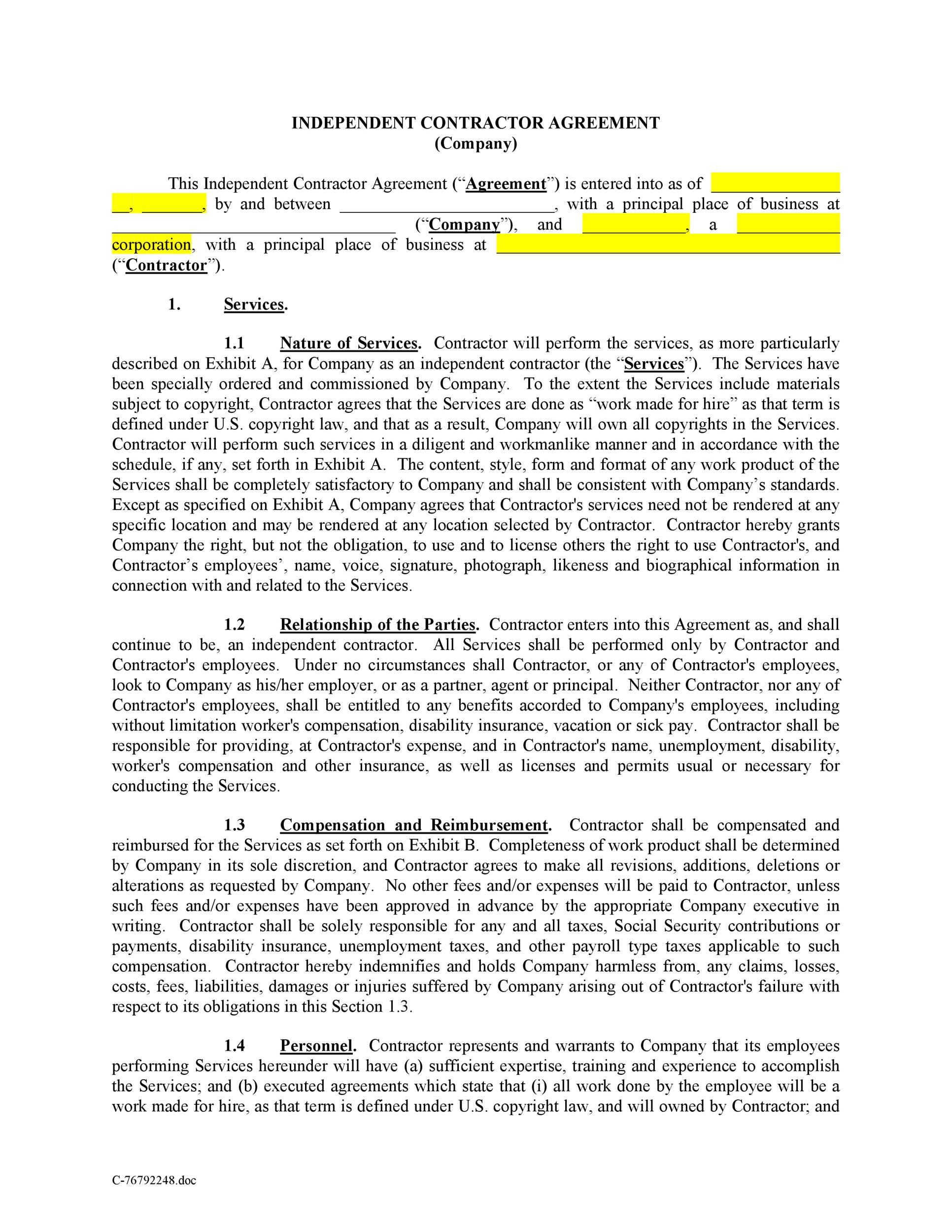

If you hire an independent contractor, you will be required to fill out a Form 1099NEC if you pay them more than $600 within a year The 1099NEC is needed to report how much income an independent contractor earns in a year You must send all completed 1099 forms to the IRS before January 31 of the following yearForm 1099 MISC is a tax form used by the IRS to track all the miscellaneous income paid to the nonemployees (independent contractor) in the course of the trade or business In a simple context, you must file 1099 MISC if you have paid any independent contractor a sum of $600 or more in a year for their services for your business or tradeIndependent Contractor Agreement (1099) An independent contractor agreement is a contract between a client that pays a 1099 contractor for their servicesAn independent contractor is not an employee In most cases, an independent contractor is paid on a perjob or percentage (%) basis, not by the hour ($/hr)

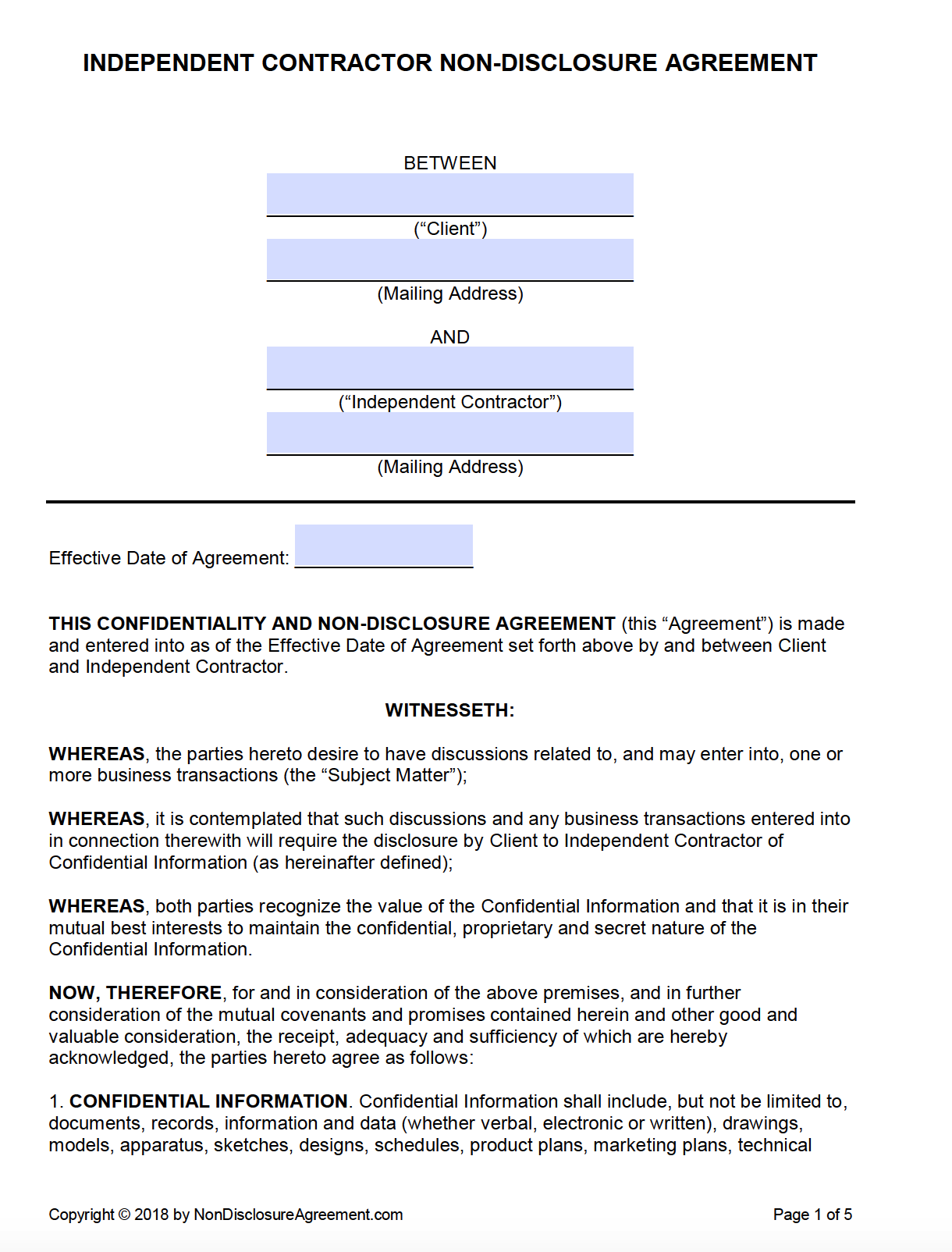

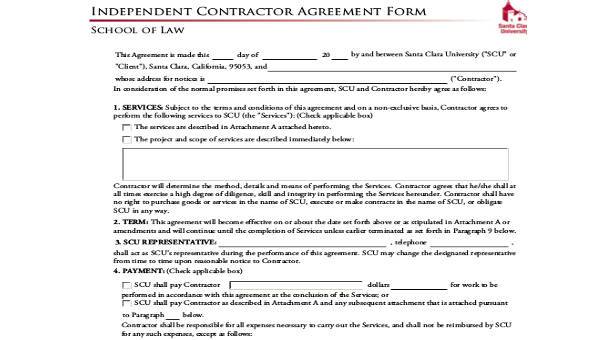

Sample Independent Contractor Agreement This sample agreement should be reviewed and approved by your attorney prior to use (when applicable), workers' compensation* and other forms of insurance, with insurers reasonably acceptable to Ministry Contractor also shall require any of its subcontractors to maintain adequate insuranceContractor shall require all employees who perform Services and/or have performed Services hereunder to sign a copy of the form attached hereto as Exhibit C and Contractor shall forward copies of all of such forms to Company within five (5) days of executing the Agreement and/or within five (5) days of assigning a new employee to performThe independent contractor nondisclosure agreement is intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound to maintain secrecy under most state laws That is, if you disclose a trade secret to a contractor without a nondisclosure

INDEPENDENT CONTRACTOR AGREEMENT It is understood and agreed that HWS shall provide Contractor with a Form 1099 in accordance with applicable federal, state, and local income tax laws To the extent either Party is required by law to demonstrate compliance with any You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting filesThe Principal and Independent Contractor hereby agree that during the term of this Agreement and any extensions hereof, this agreement and the employment of the Independent Contractor may be terminated and the Independent Contractor's compensation shall be measured to the date of such termination (i) at will by either party with 90 (ninety

:max_bytes(150000):strip_icc()/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

Who Should Receive Form 1099 Misc

Free Independent Contractor Agreement Free To Print Save Download

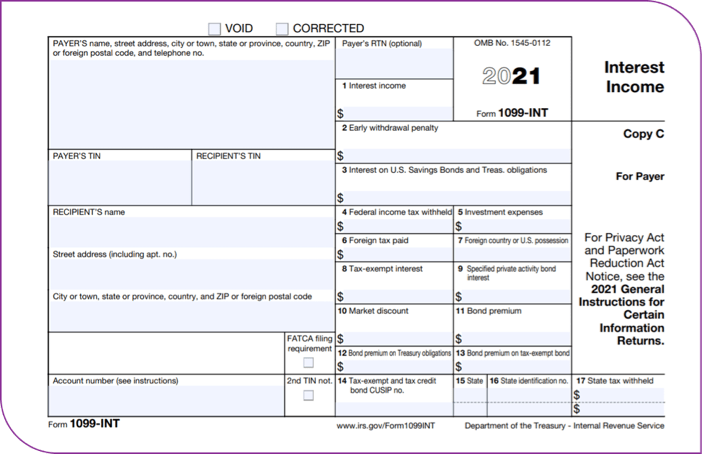

There are several variations of the 1099 form, so simply asking what is a 1099 form will not get you the answer you might be looking for As a US business owner, you probably have issued a 1099 independent contractor tax form to some of your employees or a 1099INT for interest income that you may receive from your bank However, for today's purposes, the article You have to file IRS Form 1099 to report taxes on payments to independent contractors This needs to be done for every independent contractor to whom you've paid at least $600 for services, and can be done easily with a Form 1099MISC builder Sample Independent Contractor AgreementClick on the Get Form option to start filling out Switch on the Wizard mode on the top toolbar to have more tips Fill in each fillable field Ensure that the details you add to the 1099 Termination Letter is uptodate and accurate Include the date to the form using the Date function Click on the Sign button and make a signature

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

Free Sample Independent Contractor Agreement Download Wise

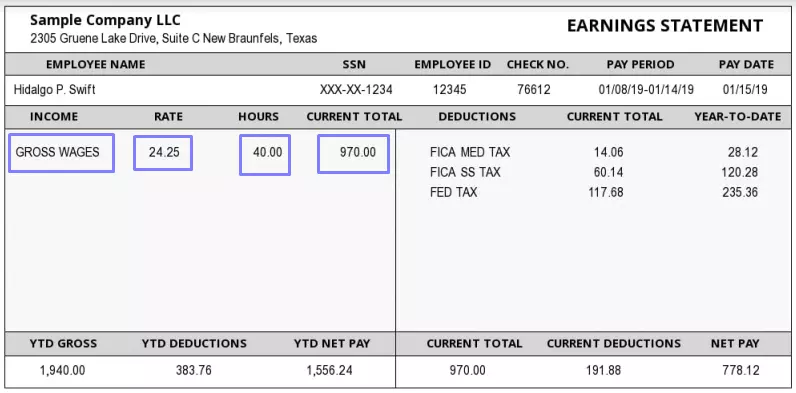

Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer1099 CONTRACTOR AGREEMENT AGREEMENT made as of _____, between Eastmark Consulting, Inc, a Independent Contractor The relationship between Contractor and Eastmark is that of an in tangible form shall be returned immediately to the disclosing party Following the termination ofCompany will report all income to Independent Contractor on IRS Form 1099 Independent Contractor understands and agrees that he is solely responsible for all income and/or other tax obligations, if any, including but not limited to all reporting and payment obligations, if any, which may arise as a consequence of any payment under this Agreement

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

Independent contractors handle taxes related to social security, medicare etc Employers have to produce a W9 to be completed by the independent contractor You may have to file information returns (form 1099MISC) to report certain types of payments made to independent contractors You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting filesDownload the independent contractor invoice template to formally request payment for most any type of independent contracting work This includes freelance home repair, graphic design, writing, and much more Be sure to accurately describe the work you performed and the charges being applied IRS 1099MISC Form – Filed by an independent contractor at the end of the year if

1099 Payroll 1099 Employee 1099 Contractor Independent Contractor Payroll Software

What Is A 1099 Employee The Definitive Guide To 1099 Status Supermoney

Get Great Deals at Amazon Here http//amznto/2FLu8NwIRS Order Forms https//bitly/2kkMEkkHow to fill out 1099MISC Form Contract Work Nonemployee Compens Report payments made of at least $600 in the course of a trade or business to a person who's not an employee for services (Form 1099NEC) Report payments of $10 or more made in the course of a trade or business in gross royalties or payments of $600 or more made in the course of a trade or business in rents or for other specified purposes (Form 1099MISC) 1099 Form Independent Contractor Pdf / Printable IRS Form 1099MISC for 15 (For Taxes To Be These can include deducting costs for your home office, vehicle expenses, advertising, continuing education, insurance pr

Pin By Carole Pellegrino On Invoice Invoice Template Business Budget Template Invoice Template Word

How To Fill Out 1099 Misc Form Independent Contractor Work Instructions Example Explained Youtube

Updated A 1099 sales rep agreement is important to have for companies that employ sales representatives It can be the difference between staying open and being forced to shut down the company Employees who only get commissions are called 1099ers due to the 1099MISC form that they receive every yearContractor shall be paid pursuant to IRS Form 1099, and shall have full responsibility for applicable taxes for all compensation paid to Contractor or its Assistants under this Agreement, and for compliance with all applicable labor and employment requirements with respect to Contractor's selfemployment, sole proprietorship or other form ofIndependent contractors are people who offer their professional services to clients They are usually selfemployed owners of small businesses that you hire for a fixed period of time or on a perproject basis Independent contractors may go by similar names such as 1099 contractors, freelancers or selfemployed workers

Independent Contractors Vs Employees Not As Simple As You Think New York Truckstop

Form 1099 Misc It S Your Yale

An independent contractor may need to file a 1099MISC form with the IRS to report freelance earnings A company employing independent contractors, will need to complete a 1099MISC form if payments to individual contractors reach a threshold set by the IRSAn independent contractor agreement is an important agreement for both someone hiring an independent contractor and the person who will be working as the contractor The agreement should outline what the work entails and what kind of payments will be rendered for servicesAn independent contractor form can be used by the contractor himself or by an organization that intends to hire the services of a contractor A contractor can use the form to register himself in the government roster, to send a proposal to the client or

Independent Contractor Pay Stub Template Fill Out Pdf Forms Online

What Is A 1099 Contractor With Pictures

Understanding 1099 Form Samples Oracle 6 hours ago This section provides a sample of the 1099DIV form, which you use to report dividends and distributions 1041 1099DIV Form SampleThese are examples of 1099DIV forms for 19 Figure 105 Example of the 1099DIV form for 19 Preprinted Version Show more See Also Sample 1099 form filled out Show For independent contractors, filing taxes is a little more complicated Contractors don't have an employer, so they're responsible for paying taxes and reporting their income 1099 contractors must use IRS Form 1040 to report income However, Form 1040 includes additional requirements for 1099 contractors2 Send the standard Loyola University Maryland Confidentiality Agreement form to the independent contractor/consultant and request their signature This certification statement must be signed by the service provider and attached to the Independent Contractor/Consultant Requisition form when submitted to Human Resources 3

1099 Misc Form Fillable Printable Download Free Instructions

Independent Contractor Agreement Template Free Pdf Sample Formswift

Contractor will furnish all vehicles, equipment, tools, and materials used to provide the Services required by this Agreement Client will not require Contractor to rent or purchase any equipment, product, or service as a condition of entering into this Agreement 5 Independent Contractor_____ ("Independent Contractor") Independent Contractor is an independent contractor willing to provide certain skills and abilities to the Employer that the Employer has a demand and need In consideration of the mutual terms, conditions, and covenants hereinafter set forth, Employer and Independent Contractor agree as follows 1 WorkIRS 1099MISC Form – To be filed by the payor of an independent contractor of any individual that was paid more than $10 in royalties, $600 in payments, or $5,000 of a buyer for resale Contractor Work Order – An outlined request that is made prior to a job being assigned that gives a quote of the costs attributed to the labor and materials associated with the work

3

1099 Misc Form Fillable Printable Download Free Instructions

The independent contractor forms are somewhat similar to contractor proposal forms but while the latter is just about the services to be offered by the contractor the former offers a comprehensive view of the agreement and the T&C to be followed by the company and contractor The most important document you will need to hire freelancers and independent contractors is an Independent Contractor Agreement This outlines the terms of a deal between a client and contractor and makes the agreed terms legally binding It will also be necessary to have an IRS form W9 available when you begin the process of hiring a contractorIn the simplest of terms, nurse practitioners that are 1099 employees are independent contractors They receive a different tax form than that which accompanies more traditional W2 employment status and are not technically employees of the company for which they work

Independent Contractor Agreement Ent Example Free Florida Word Pdf E2 80 93 Eforms Document Sample

Free Florida Independent Contractor Agreement Pdf Word

Form 1099NEC Beginning with tax year , Form 1099NEC replaces the previously used Form 1099MISC for independent contractors This form is used by companies to report payments made in the course of a trade or business to others for services It must be filed by any company that pays an independent contractor $600 or more during the yearIn addition to the IRS forms that an independent contractor must file, their clients and employers are required to submit information regarding their transactions as well Any individuals or entities who have paid the independent contractor more than six hundred dollars ($600) within a tax year are required to file Form 1099 which details theIndependent Contractor (1099) Invoice Template Ashley Tudor Invoice The independent contractor invoice template permits the individual or company to charge a client for job given Generally, the invoice will incorporate a blend of work and materials used This invoice might be useful for any sort of contractor, painters, laborer

Printable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Intended For 1099 Template 16 Irs Forms 1099 Tax Form Tax Forms

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

What Barber Shop Owners Need To Know About The W 9 And 1099 Tax Forms Barber Accountant

1099 Form Fileunemployment Org

Form Irs 1099 Nec Fill Online Printable Fillable Blank Pdffiller

Independent Contractor 101 Bastian Accounting For Photographers

1099 Misc 14

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

1

Airbnb 1099 Forms Everything You Need To Know Shared Economy Tax

Your Ultimate Guide To 1099s

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

Form 1099 Definition

Free Independent Contractor Agreement Templates Word Pdf

How To File 1099 Misc For Independent Contractor

Independent Contractor Agreement Form California Elegant Independent Contractor Tax Forms Sample 1099 Form Beautiful Luxury Models Form Ideas

50 Free Independent Contractor Agreement Forms Templates

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

How To Make Sure Your 1099 Misc Forms Are Correct Cpa Practice Advisor

Printable Form 1099 Misc 21 Insctuctions What Is 1099 Misc Tax Form

Instant Form 1099 Generator Create 1099 Easily Form Pros

1099 Nec And 1099 Misc Changes And Requirements For Property Management

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

Form 1099 For Nonprofits How And Why To Issue One Jitasa Group

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Form 1099 Nec Form Pros

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

:max_bytes(150000):strip_icc()/FormW-94-d634d707ffee44839b5a46c998bd71aa.png)

What Is Irs Form W 9

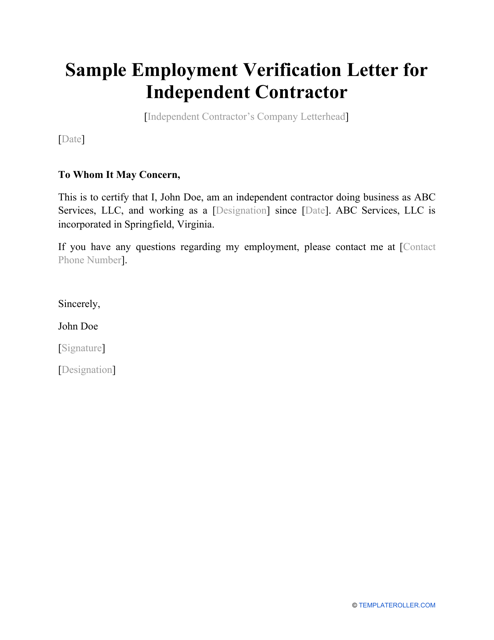

Sample Employment Verification Letter For Independent Contractor Download Printable Pdf Templateroller

Irs 1099 Misc Form Free Download Create Fill And Print Wondershare Pdfelement

Who Are Independent Contractors And How Can I Get 1099s For Free

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at1.17.00PM-ef62520d45364d5ea8a09564a54d5757.png)

Form 1099 R Distributions From Pensions Annuities Retirement Or Profit Sharing Plans Definition

1

1099 Form Fileunemployment Org

50 Free Independent Contractor Agreement Forms Templates

What Is The Account Number On A 1099 Misc Form Workful

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

1099 Misc Form Fillable Printable Download Free Instructions

1099 Misc Instructions And How To File Square

Form Irs 1099 Nec Fill Online Printable Fillable Blank Pdffiller

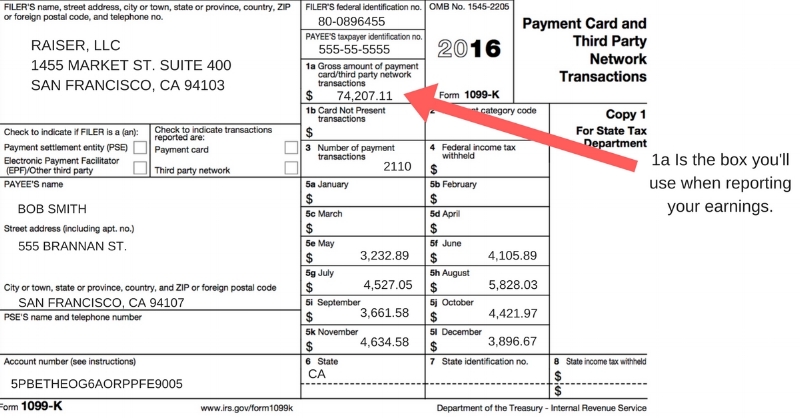

Form 1099 K Wikipedia

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Download 1099 Forms For Independent Contractors Brilliant Fake Pay Stub Sample Elegant Fake Proof Insurance Templates With Models Form Ideas

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec Instructions And Tax Reporting Guide

Free 12 Sample Independent Contractor Agreement Forms In Pdf Ms Word Excel

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Guide To Creating A 1099 Pay Stub Check Stub Maker

Fill Out A 1099 Misc Form Thepaystubs

1

Free Independent Contractor Agreement Template 1099 Pdf Word Eforms

What Is A 1099 K Stride Blog

How To Fill Out Form 1099 Misc Youtube

New Form 1099 Reporting Requirements For Atkg Llp

Choosing 1099 Box Types 1099 Nec And 1099 Misc

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

How To Pay Contractors And Freelancers Clockify Blog

Free Independent Contractor Agreement Pdf Word

Independent Contractor 101 Bastian Accounting For Photographers

Choosing 1099 Box Types 1099 Nec And 1099 Misc

Independent Contractor 1099 Invoice Templates Pdf Word Excel

1099 Nec And 1099 Misc Changes And Requirements For Property Management

1099 Form 19 Pdf Fillable

Instructions For Forms 1099 Misc And 1099 Nec 21 Internal Revenue Service

Irs Form 1099 Misc Download Fillable Pdf Or Fill Online Miscellaneous Income Templateroller

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About 1099s

What Tax Forms Do I Need For An Independent Contractor Legal Io

Irs Takes Non Employee Compensation Out Of 1099 Misc New Form 1099 Nec Cpa Practice Advisor

Paid Family And Medical Leave Exemption Requests Registration Contributions And Payments Mass Gov

Small Business Tax Preparation For Independent Contractors

Free 9 Independent Contractor Agreement Forms In Pdf Ms Word

Irs Form 1099 Reporting For Small Business Owners In

Printable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Cpa Practice Advisor

50 Free Independent Contractor Agreement Forms Templates

Form 1099 Misc It S Your Yale

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

How To File 1099 Misc For Independent Contractor

/documents-when-hiring-a-contract-worker-398608_final-c7b9e3e0f1704d388f723fe60239b079.png)

3 Documents You Need When Hiring A Contract Worker

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

1099 Form Irs 18

How To File 1099 Misc For Independent Contractor

Adding 1099 Contractors To Your Practice How To Start Grow And Scale A Private Practice Practice Of The Practice

Independent Contractor Contract Template The Contract Shop

0 件のコメント:

コメントを投稿